63+ what percentage of your monthly income should your mortgage be

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web When your down payment is less than 20 percent your costs rise.

How Much Should My Mortgage Be Compared To My Income

Compare More Than Just Rates.

. Web What percentage of your monthly income should go to mortgage. Web What percentage of income do I need for a mortgage. 2000 is 33 of 6000 If you use a calculator youll need to multiply the.

You can find this by multiplying your income by 28 then dividing. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. This means that if you want to keep.

Find A Lender That Offers Great Service. Comparisons Trusted by 55000000. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Its Fast Simple. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most. Estimate your monthly mortgage payment.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre.

Compare More Than Just Rates. Apply Today Save Money. Compare Lenders And Find Out Which One Suits You Best.

Looking For Conventional Home Loan. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

Web It typically ranges from 058 to 186 of your total mortgage amount and you will need to factor this in if your down payment is less than 20. Ad See How Competitive Our Rates Are. You typically have to pay private mortgage insurance which can cost up to 1 percent of the.

Find A Lender That Offers Great Service. Ad See how much house you can afford. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Web By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633.

How To Craft A Life On 120 000 Yr Pete The Planner

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much House Can I Afford Moneyunder30

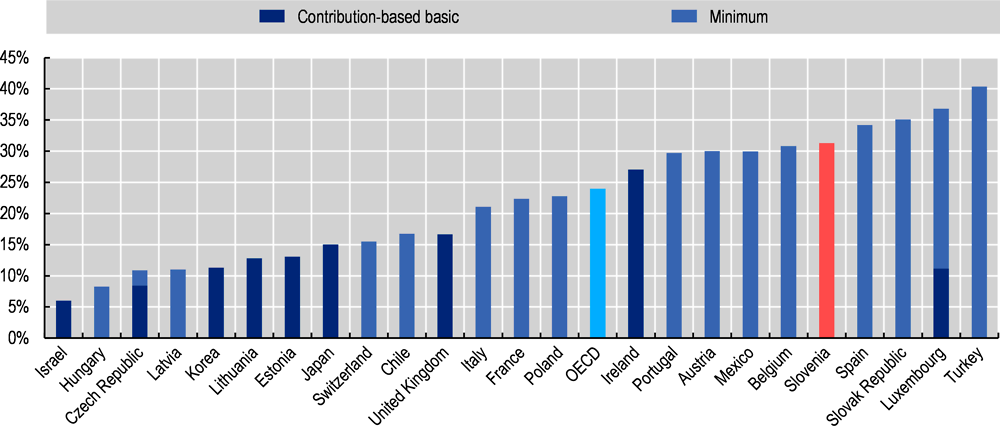

3 First Tier Benefits Oecd Reviews Of Pension Systems Slovenia Oecd Ilibrary

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Your Mortgage Hometap

What Percentage Of Income Should Go To Mortgage Banks Com

How Much House Can You Afford Calculator Cnet Cnet

Brady Bell Home Mortgages In Idaho Applywithbrady Com

What Percentage Of Income Should Go To Mortgage

How Much House Can You Afford Readynest

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income Should Your Mortgage Be